Introduction#

Jo&Ko is a visionary tech company merging Bitcoin’s philosophy with cutting-edge AI. We believe that Bitcoin will change the world, and no consolidated asset on Earth can emulate its returns in the next decade. At the same time, a successful startup can outperform Bitcoin in the short term. That’s why our treasury is allocated to BTC.

Guided by Bitcoin’s philosophy, we build long-lasting AI products. With over a decade of expertise in Artificial Intelligence and Software Engineering, we create AI-powered digital products that people love and that deliver real-world impact.

Speculation isn’t part of our playbook. We believe that managing expectations is a crucial skill in an unpredictable world. No matter the industry or the objective, we stay true to our principles: under-promise, over-deliver. Always.

In conclusion, we are Jo&Ko, merging the best of AI & Bitcoin (without the need to create a crypto token that claims to pre-train an LLM using grandma’s phones).

Assumptions and Beliefs#

Your beliefs are your strategy. What you believe shapes your path. It makes hard decisions easier because you already know what matters most.

The Fiat System is Broken#

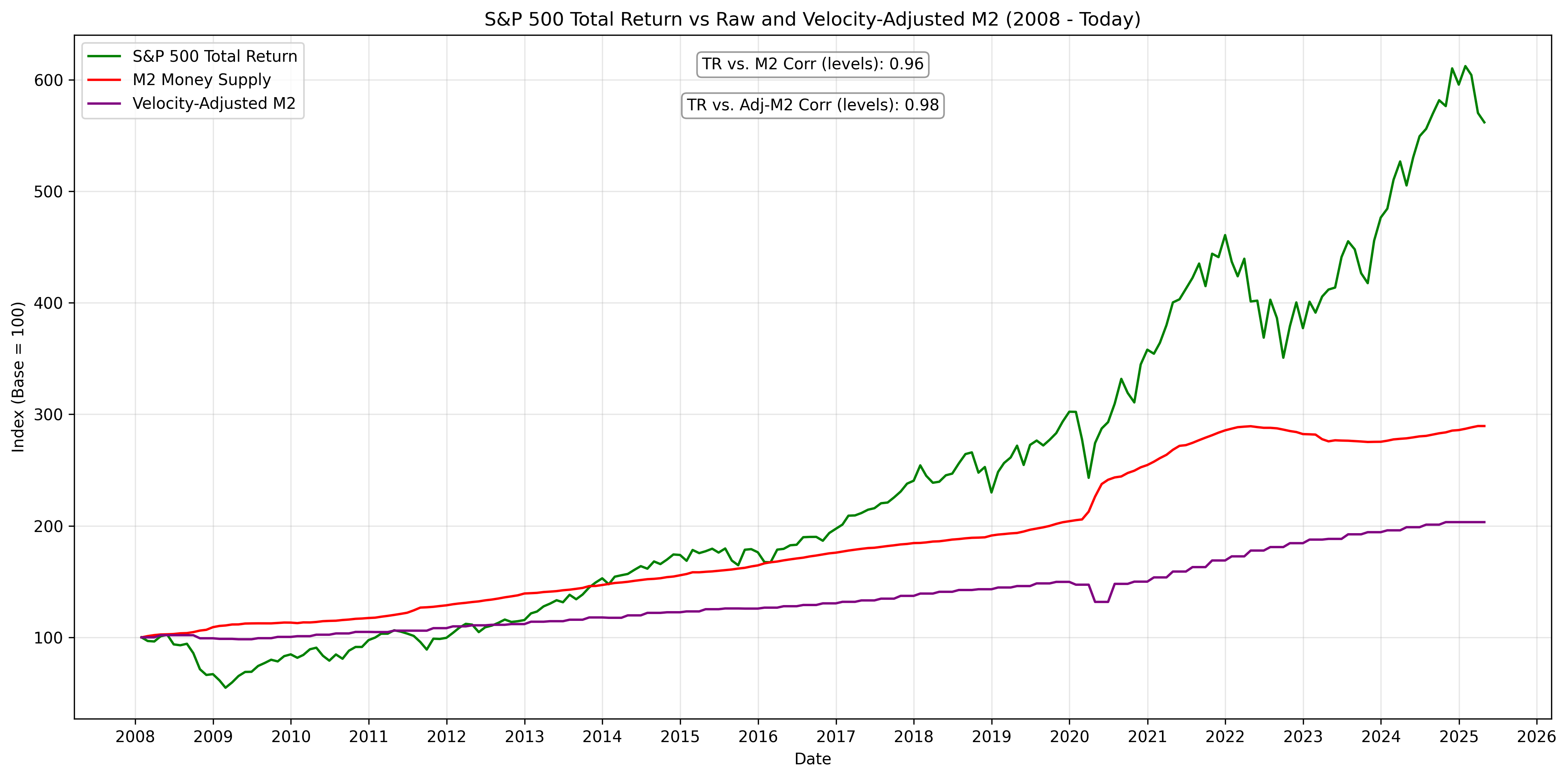

If you still think that the Fiat system can survive, we would suggest you take a look at the following image:

The graph illustrates the relationship between the S&P 500 Total Return (green line), US M2 Money Supply (red line), and Velocity-Adjusted M2 (purple line) from 2008 to present. Notice the incredibly high correlation between stock market performance and US dollar money supply expansion (0.96–0.98 at levels). While the S&P 500 has outperformed in nominal terms, much of that performance mirrors monetary expansion.

This reflects decades of Keynesian thinking, which promotes expanding the money supply to stimulate growth. In contrast, Austrian economics argues that real value subjectively comes from scarcity and marginal utility, not printing more currency.

The correlation between M2 and asset prices exposes a troubling reality: what appears as “growth” is largely the effect of monetary expansion. When measured against the true expansion of the US money supply, real returns are far less impressive. This isn’t wealth creation, it’s currency debasement. Every new dollar printed reduces the value of all dollars in circulation, eroding purchasing power for those holding cash or even stocks.

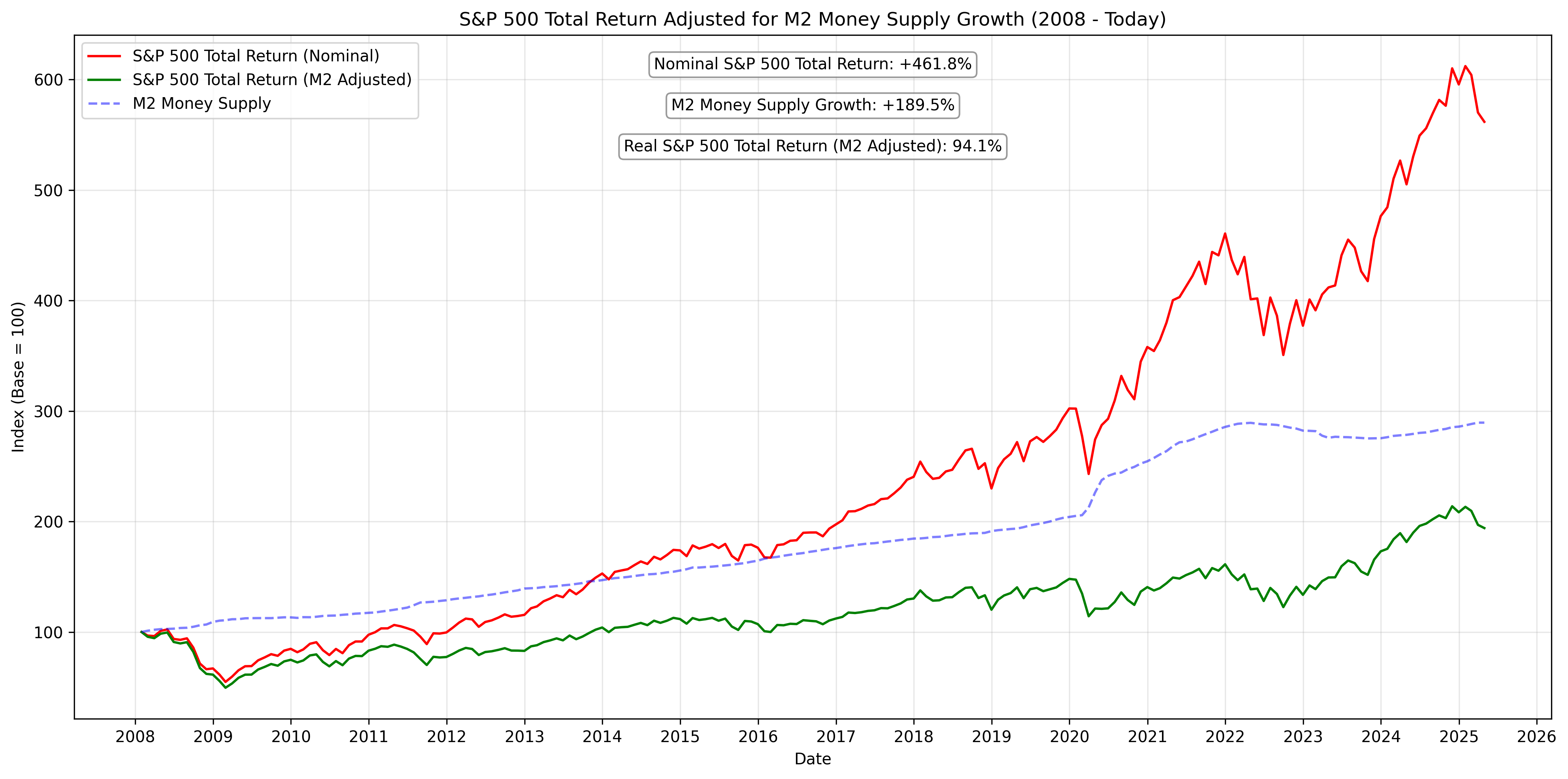

The S&P 500 has shown a nominal total return of +461.8% over the past 17 years, appearing impressive at first glance. However, when adjusted for the US M2 money supply growth of +189.5%, the real return drops dramatically to just 94.1%. What appears as extraordinary market performance is largely the result of currency debasement rather than true economic value creation.

Beyond the loss of purchasing power and the Cantillon effect, one of the most corrosive effects of fiat money is how it distorts human behavior. Fiat systems are inherently inflationary, which means our money is worth less tomorrow than it is today. The result? A system that punishes saving and incentivizes short-term consumption over long-term thinking.

Modern Keynesian economists claim that continuous consumption is necessary for economic growth. But this belief is just a convenient narrative to justify constant monetary expansion. In truth, sustainable value is created through saving, increased productivity, and long-term vision. A society that feels forced to spend everything today because tomorrow’s money will be worth less is a sick society. It loses the ability to plan, to build, and most importantly, to trust in the future.

Bitcoin inverts this dynamic. With absolute scarcity and zero dilution risk, it encourages low time preference behavior: building, conserving, and investing with a multi-decade horizon. It rewards those who delay gratification and think beyond the next quarter.

The Startup Ecosystem is Kind of Broken#

Investing as an early-stage investor is a tough game. Most startups don’t make it, and even when they do, your money can stay locked up for years.

Around 70% of startups fail at the pre-seed stage. For those that raise a seed round, only about 13% manage to secure a Series A within two years. Historically, this rate was closer to 20–30%, but it’s been dropping due to tighter investor scrutiny and longer fundraising cycles.

Even if a startup becomes a unicorn (valued at over $1 billion), that doesn’t guarantee a return. As of 2024, about 74% of unicorns remain private, up from 51% in 1999. Among U.S. unicorns, only 1 in 6 are considered viable IPO candidates today.

When exits do happen, they take time. The average unicorn takes about 2.9 years to exit after reaching a $1 billion valuation. Some take over four years. Meanwhile, your investment is tied up, and liquidity options are limited.

The venture capital landscape has shifted. Instead of focusing on building sustainable businesses, the emphasis is often on creating companies that appeal to larger VCs for the next funding round.

In today’s market, with rapid advancements in AI and increased developer productivity, the traditional “buy vs. build” decision leans more towards building in-house. This makes acquisitions less attractive, further reducing exit opportunities for startups.

It’s a challenging environment. The system seems skewed, making it harder for early investors to see meaningful returns.

Product Building Philosophy#

We are product builders. We focus on crafting high-quality AI-powered solutions, and we do it with a clear identity.

In today’s world of consumerism and short-term thinking, startups often prioritize hype over substance; they burn resources to sell a story, not to develop real innovation. Investors, often unprepared, end up funding ideas that exist only as demos, not products. The Devin story shows this perfectly.

Even big tech companies, despite having the resources to develop products thoughtfully, are acting impulsively, chasing short-term stock fluctuations instead of pursuing meaningful innovation.

Generative AI makes this even worse. Indeed, an AI product is easy to demo but hard to make reliable. A Twitter showcase might look impressive, but turning it into a robust, real-world product requires more than marketing. It demands true technical execution.

We believe this system goes against capitalism’s very philosophy. Capitalism thrives on value creation, not illusion.

That’s why we build differently. We don’t chase quarterly results. We build because we love it. We take our time. We go deep when needed. We prioritize quality over speed. We work to earn real trust from our users.

We reject the lean startup method for AI. If a product isn’t ready for real users, it’s not a product. It’s just an idea, easy to copy, leading to immediate churn once users see it doesn’t work.

Go to Market Strategy#

In today’s connected world, a truly remarkable product can create its own momentum. People will use it, love it, and spread the word. We are not aiming to convert the masses overnight. Instead, we fully embrace the 1,000 true fans principle: our goal is to earn the trust of a small group of dedicated users, our first hardcore fan base. These are the people who will try everything we make, send us bug reports at 2 AM, and tell their friends not because they were paid to, but because they care.

Huge growth is not the goal, at least not now. What matters is building something so good that the first 100 users bring in the next 900. In a world where attention is fragmented and short-lived, the strongest marketing channel is still word of mouth from someone who truly believes in what you’re doing.

With an amazing product, you don’t need massive teams or big budgets. Enthusiasm and direct relationships do the rest. We’ll grow one fan at a time, because that’s how you build something that lasts.

Operations#

Single Person Company?#

Sam Altman said: “In this decade, we will see the first one-person billion-dollar company”.

We are not a single person, but a very small, focused team of Software Engineers and Machine Learning Experts, driven by our ability to deliver exceptional results and a strong dislike for the status quo.

Lean and Efficient Execution#

We operate with minimal overhead and maximum impact. Instead of unnecessary meetings and bloated processes, we rely on asynchronous collaboration, structured planning, and relentless execution.

- Minimal Documentation, Maximum Execution – We don’t waste time writing excessive documents that get lost in day-to-day operations. Every initiative moves directly from idea to implementation, guided by clear milestones and structured tasks.

- Essential Tools, No Clutter – GitHub for code, Linear for project management, Notion for knowledge sharing, and Slack for streamlined communication.

- Intentional Planning, No Wasted Motion – Monthly planning ensures alignment, while lightweight daily check-ins keep progress on track without disrupting focus.

Deep Focus#

In today’s fast-paced ecosystem, it’s easy to get distracted by the constant stream of new technologies. However, keeping up with every trend is both challenging and time-consuming, stealing the most valuable resource a team can have: focus. That’s why we prioritize only major research updates that directly benefit our product. Nothing more, nothing less. We dedicate all our working hours to one goal: building an exceptional product.

Core values#

Here’s what we stand for:

- Quality over quantity

- Long-term vs. short-term

- Value over hype

- Work hard, play harder

- Focus is saying no

FAQs#

What is the product you are working on?#

We’re shipping Kosuke, the first open-source vibe-coding platform. If Lovable is Fiat, Kosuke is Bitcoin. It’s transparent, community-owned, and built to last. Every part of it reflects our core values: high quality over hype, freedom over control, and long-term thinking over short-term wins. No vendor lock-in, ever. Just real engineering, done right.

Do you invest in any crypto projects besides Bitcoin?#

We don’t invest in other crypto projects. We only save in Bitcoin. We believe that anything other than Bitcoin is a shitcoin. Centralized chains can print tokens or control the protocol at will, losing the key benefits that make Bitcoin special: censorship-resistant, secure, and distributed. Without these, a shitcoin is no different from a centralized currency run by a central bank.

Why are you betting so much on Bitcoin?#

We have a dedicated page for Bitcoin here.

What does Jo&Ko mean?#

It’s the origin of a friendship. Two old friends, similar in many ways but also very different, just like Bitcoin and AI.